USBSwiper VT Powered by PayPal

2.99% + 29¢

Stripe VT

3.49% + 30¢

U.S. Processing Rates as of January, 2025

Start Saving on Fees Today!

Sign up for USBSwiper - Powered by PayPal, and start processing credit cards at a lower rate than what you are getting with Stripe!

Introduction

The choice of a payment processor is crucial and complex for any online retailer, be they a solo WooCommerce operation or a thriving business. PayPal and Stripe are two of the most well-liked and popular choices, but deciding between them might be challenging.

All companies have their own procedures for handling payments and running their business, particularly when it comes to credit card processing using a virtual terminal. When contemplating a credit card processing solution you should compare Stripe vs USBSwiper’s Virtual Terminal Powered by PayPal carefully to find the one that best fits your business’s needs for receiving payments. Read on to find out more.

What is a Virtual Terminal?

As a result of the changing climate, businesses are giving customers more ways to pay, such as in person, online, or over the phone. This is where a virtual terminal comes in.

When customers pay with credit or debit cards, merchants can enter their details into a secure website or screen called a virtual terminal. It’s electronic credit card processing’s “virtual” replacement.

Customers can’t use virtual terminals; only businesses can. They are usually a browser-based web page provided by the merchant’s payment company. They are used for payments where the cardholder is not present, like when booking a hotel reservation over the phone or any other type of transaction that could be made over the phone or through an online order system that does not actually process payments.

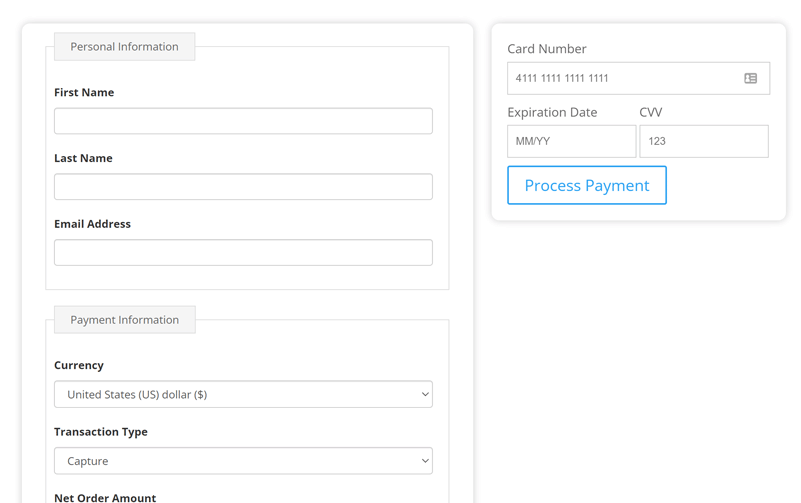

Sample of a Virtual Terminal window.

How Do Virtual Terminals Work?

In place of a traditional card reader, virtual terminals use digital programs that perform comparable functions.

With a traditional card reader type system, a customer can pay for their purchase using a physical card machine by tapping or inserting their card and entering their PIN (for debit cards). The payment is finalized electronically afterwards.

In contrast, while using a virtual terminal, the business or merchant simply:

- Accesses the virtual terminal of your chosen payment processor through the computer web-browser,

- “Keys” (manually enters) the customer’s credit card information into the secure webpage (you can do this while they’re still on the phone).

- Process the payment by clicking the submit button. Yep, it’s that simple!

Your virtual terminal is accessible from any device with an internet connection, including desktop computers, laptops, tablets, and even smartphones. There are varying degrees of access and authority for other people (staff members).

All data is processed through PCI Compliant procedures, and the latest financial security mechanisms are used by the corresponding virtual terminal technology, so you can rest easy knowing your transactions are safe and are maintaining the security of your customers’ personal data at all times. You and your employees must also ensure that all credit card information entered into the system is not written down anywhere or stored as you would not want anyone to access it and use it fraudulently.

Why Use a Virtual Terminal?

Setting up a Virtual Terminal is a very simple process. In fact, most service providers will have you fully operational in less than 24 hours. Also, a good Virtual Terminal System should also let you keep track of all your transactions, process authorizations and refunds. You’re basically turning your computer, tablet or phone into a point of sale system without having to set up any complex systems or hardware. There may also be the ability to set up dropdown product lists for simple invoice populations.

Another benefit is that you can accept many different types of payment. Some Virtual Terminal solutions even include accepting checks, gift cards, and cash as payment methods in addition to the more common credit and debit cards. It’s possible that you can use various methods to make a single payment.

Payments for subscription services can be collected automatically with the help of recurring billing. Payment plans can be managed and updated through your own system’s back end using an API, giving you greater flexibility to meet particular business demands.

A virtual terminal only requires a computer and an internet connection, unlike traditional payment options that may necessitate a card reader or other costly equipment.

Payment gateways in use today have dozens of safeguards built in to prevent fraud, and the greatest fraud management technologies are built into today’s Virtual Terminals. One of the primary reasons someone would be apprehensive to use a Virtual Terminal is the possibility of fraud, but in reality, they are just as secure as online payment gateways.

Why USBSwiper Powered by PayPal is Better Than Stripe’s Virtual Terminal

Let’s cut straight to the heart of the matter. You may be asking if there is really much of a difference between Stripe and PayPal, two of the most well-known and widely-used online payment options. After all, you can use either one to start accepting payments from clients right away and also tie in their processing to your website as well. At first glance, they may even seem to be pretty much the same.

However, as we’ll see, there are a few significant distinctions between the two that can make them more or less suitable for various kinds of enterprises. Fees are certainly an area where they differ, and it’s a very important one to consider.

Fortunately, both PayPal and Stripe’s base plans are completely free to use. As long as your business is not a prohibited category (adult toys, gun sales etc.) your account should get approved very quickly… sometimes immediately. Thus, joining is simple. Setup an account and you can get started right away.

However, there are predetermined pricing structures that will be applied once you begin processing payments. Stripe for US customers is 3.4% + 30¢ but the USB Swiper Virtual Terminal Powered by PayPal will give people in the US a rate of 2.99% + 29¢ – a substantial savings!

With Stripe having just announced their price increase which takes effect on November 10, 2022, now is the perfect time to switch to USBSwiper’s Virtual Terminal. You’ll save money and have a highly reputable VT credit card processing system for your business.

Now that you know which processing terminal to use, let’s look closer into why you would need one at all.

Start Saving on Fees Today!

Sign up for USBSwiper - Powered by PayPal, and start processing credit cards at a lower rate than what you are getting with Stripe!